Master Class: How to Use Outsourced Support to Strengthen Your Small Business with Virtual Receptionists and Bookkeepers

Master Class: How to Use Outsourced Support to Strengthen Your Small Business with Virtual Receptionists and Bookkeepers

You shouldn't have to handle all of the responsibility of running your business yourself. You can give yourself more control over your time and still get it all done if you hand off some of your easily-delegated, but time-consuming work to trained professionals or automate them through highly trusted services.

On July 26, 2019, Smith.ai hosted a webinar, during which Rachel Halldorson, a member of the business development team at Bench Accounting, joined Maddy Martin, head of growth and education at Smith.ai, to discuss the common problems that small businesses face in managing their time and tasks as well as how they can prioritize high-impact solutions to not only simplify their workload, but improve operations and efficiency, reduce interruptions, and increase their profit margins, among other benefits, in order to build a more sustainable, scalable small business.

For a deeper look at this discussion, we've provided a full transcript of the webinar below, edited for readability. You can watch the full webinar by clicking on the video below. This webinar is also available to watch for free on YouTube. For more tips and tricks on how to better run your small business, subscribe to our YouTube channel!

Moderator

Maddy Martin

Head of Growth and

Education at Smith.ai

Speaker

Rachel Halldorson

Business Development at

INTRODUCTION

MADDY MARTIN, HEAD OF GROWTH AND EDUCATION AT SMITH.AI:

Welcome, everyone, thank you for joining us.

This is a webinar jointly presented by Smith.ai and Bench Accounting, and I have Rachel Halldorson here. I'm Maddy Martin with Smith.ai, and we're going to be talking about strengthening your small business with outsourcing and automation.

So just one housekeeping note, we do have the deck link available to you so that you can review the slides at your leisure; it is bit.ly/Bench-SmithAI.

So, anything that we don't get to or you want more information on, or you want to review our contact information, which is at the end, then feel free to take a look and that will be available to you online anytime.

So, I'll introduce myself and Smith.ai, and then Rachel can introduce herself and Bench. I'm the head of growth and education for Smith.ai. We are a virtual receptionist service for live calls and website chat.

And actually, now, we've handled over a million conversations for solopreneurs and small business owners. And Smith.ai specializes in handling not only inbound and outbound calls, taking messages, and transferring, but also really completing work for you.

So our receptionists are able to screen new leads, to help existing clients, to get paid invoices with credit cards by phone, to schedule appointments, and to follow up on clients who you want to reconnect with, to refer people who are not a good fit to firms you recommend — it's a very robust service that we're able to offer.

So not your standard answering service by any means.

And as far as not your standard service goes, I will let Rachel talk about their accounting and bookkeeping services.

RACHEL, BUSINESS DEVELOPMENT AT BENCH ACCOUNTING:

Yeah, thanks, Maddy. Hi everyone. I'm Rachel.

So I work in business development here at Bench Accounting. I came from sales previously, so I have spoken to many clients about on-boarding their businesses with bookkeeping.

We are North America's largest online bookkeeping service for small businesses and what really sets us apart is the bookkeeping — or the software as a service. So we actually have the human connection side along with our own software, and we try to make bookkeeping as painless as possible for small business owners so that they can get back to doing what they love.

GOALS AND OBJECTIVES

MADDY:

Wonderful. Thanks, Rachel. So let's just talk about our goals and objectives today. We're going to talk about:

- How to better capture, qualify, and convert new potential clients.

- How to capture more earnings through effective bookkeeping and understanding where you’re spending and overspending to reduce your year-end tax bill.

- How to use a virtual receptionist to prevent late nonpayment.

- How to choose the best bookkeeping solution for your small business and pinpoint the greatest inefficiencies for high impact solutions using automation and outsourcing to your advantage at often a cost that you would expect to be more expensive than it is.

It’s quite affordable, especially when you consider, as Rachel and I have often talked about, the opportunity cost of your time and the opportunity for mistakes when you're not specializing in customer service, lead capture, bookkeeping, all of these things that are special skills that you can capably outsource to trusted services.

COMMON PROBLEMS SMALL BUSINESSES FACE

So why are we talking about this topic in the first place?

There are a lot of dilemmas that small businesses face.

So we see often with our clients who come to us that they are really plagued by a dilemma of knowing that potential clients demand an instant response, but the incurring interruption and the loss of productivity there really is a struggle for them to face. How do you decide to pick up the phone from a new client call versus getting work done for an existing client that you're obliged to do?

So that's something that, you know, for small business owners who have limited time, it's a daily issue that they face.

One of the other things that we see is that technology can improve efficiency and productivity, especially for small business owners that are competing with bigger firms. It can provide a competitive advantage in terms of that efficiency, but it can be, for certain solutions, time-consuming and costly to implement new tech.

So how do we provide tools that are able to give you what you need and are easy to implement?

Also, we find that when it comes to things like payment collection and the initial screening process, you know, there is, especially when clients are concerned, there's a personal relationship with the small businesses that they work with. Whether it's an attorney or financial advisor or IT firm, there's a close business relationship that starts to feel like family for many small businesses and their clients.

And when you have to follow up on late payments or bookkeeping matters, it can be very uncomfortable. So outsourcing can be a great solution for that too.

And then there's also the matter of control. So when we talk to small businesses around the country, we find that a lot of people go into a small business and start their own business because they want control over their work, over their work-life balance, over the methods through which they work, how much they're going to work, etc.

And what ends up happening, often times, is that you take on all this control of creating a small business and then you realize, at some point, that there's just too much on your shoulders and you want to release control, but you don't know how because you don't want to risk quality, you don't want to risk work being completed or erosion of trust in your business that you've established with that close personal relationship through having control over every interaction.

So the issues here are that you end up not picking up the phone to get work done or you miss revenue because you don't follow up with the clients on their late invoices because you're uncomfortable, or you don't want to jeopardize the relationship.

Or you have poor work-life balance and higher stress because you have an unwillingness to hand off some of these tasks that are being automated and outsourced by other small businesses like you, but it's just not within your comfort zone.

And you find that you're getting sometimes negative reviews because you're not as responsive as you have hoped to be and you know you can be.

So I will also say to Rachel, you know, if you have anything to contribute here, we would love to hear your perspective on the accounting side.

RACHEL:

Yeah, I think you pretty much nailed it right on the head. We see a lot of clients— like they're really uncomfortable speaking to someone about their finances; it's a very intimate subject.

And a lot of people don't want anyone else knowing what's going on behind the scenes in their business, and that results in them taking things on that they don't necessarily know how to do. It results in late fees, it results in having to pay a CPA huge amounts at the year's end.

And often we'll have clients calling in tears so upset because they've just let it go for so long. And we see so many people that truly can turn their business around by outsourcing these things.

MADDY:

Absolutely.

There's deep frustration that happens with some of the software tools that are not backed up also by real people helping you. And I think that's one of the things that's most unique about our two companies, is that we're saying "Yes, there is a phone system solution." "Yes. There is a chat software solution."

All of these technologies are available to you, but that's staffed and assisted through our teams that can help you that are specialists in handling these communications or handling these accounting matters.

RECOMMENDED SOLUTIONS

So, what are some things that you can do that we recommend?

Well, the first is to really reduce your involvement in routine communications and admin. Empower people to DIY through online scheduling, through online bill pay, through credit card payments. This results not only in greater completion of these tasks, but also faster completion of these tasks.

You know, it takes a while and checks can get lost in the mail, or someone's gonna make time to drop it off to you. If you have an online payment solution, you have an online calendar, and there's less back and forth, there's less delay, there's less risk of that actually being completed.

What we also want to do is minimize time. Automate and outsource the lead capture, qualification, nurturing, also those billable, follow-up tasks. So that you can get back to the work that is the nature of why you have your small business.

And you want to also maximize your resources, find money that you've been missing out on, and maybe Rachel, that's something you'd like to speak to.

RACHEL:

Yeah, a lot of times, like back to the point on the last slide, you don't know what you don't know. We see that so many times — and I'll touch on this later in the webinar too, but so many times we'll see clients come in missing out on deductions or not realizing they're paying for certain subscriptions until they start with a professional and saving hundreds, even thousands of dollars every single month.

And then as well on the finance side, like you're getting back all these billable hours that you're wasting trying to figure something out that you're not an expert on. So why not hand it off for a few hundred dollars a month, so you can actually spend that time doing what you went into business for?

MADDY:

Absolutely, and I mean that payment is immediately recaptured in what you're able to find as a result of doing better bookkeeping, for example. Of not missing calls for new potential clients, you know, these solutions pay for themselves and you just have to experience it to kind of see that proof in action.

And one of the things that we also talk about is setting boundaries. So not only improving all these ways that things are done for your business, but also setting expectations that allow you the leash you need with leads, with clients, so that you are setting boundaries and managing your time and the tasks that you will and won't do.

So when you set goals for yourself — sometimes they're revenue-related goals, sometimes it's also work-life balance and more qualitative goals — and think about what boundaries you're going to set for yourself around what you will and won't do, similarly to ow you set them up with leads and clients around what you will and won't offer as a service.

And then as much as possible, when we talk about outsourcing and automation, we also want to sync with these systems. So that if there is, let's say, a conversation that happens, or a transaction that happens, that is reflected in your business software, in your CRM, or in your marketing automation software.

So any of these services that you are using, they connect with your other services, which reduces the burden of work on you, too.

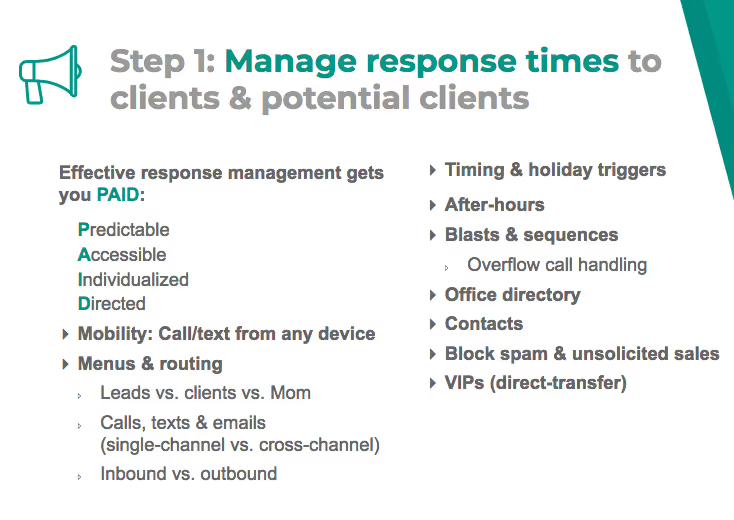

MANAGE RESPONSE TIMES

So what we recommend is managing your response times to not only clients, but also leads. And when it comes to leads, oftentimes we talk about speeding up your response time and handing off the responsiveness to receptionists like ours.

So, one of the things that's really important is that you have a consistent delivery of conversations and communications, whether it's phone, chat, email, or text message.

And believe me, if you're not texting your clients, they are probably trying to text you and you may not have texting enabled, but more and more we're seeing clients of every generation, not just millennials texting businesses that they're used to working with.

And a lot of that has to do with the rise of apps and interacting with businesses and things like Yelp and Google My Business that allow you to interact in real time.

People are translating that to their text messaging as well. And what I encourage you to do is look at all of the channels where you interact with clients, whether it's your website, your contact form, your phone number, and set standard levels of the service that you're going to provide and the responsiveness that you hold your business to, so that you have a goal and sort of a true North.

And one of the most important ways to do that is to set up your systems properly so that you can have these boundaries in place. And one of the most important things is not having a personal cell phone number for running your business.

We really encourage you— typically these days, 20, 30 bucks a month is all you need to pay to have a business phone line that is texting enabled and then you can have calls routed to your personal cell phone as the device, but not that number. And there are a couple benefits here.

The first is obviously you don't have to carry two cell phones around, but your business number is portable with you. The second is that you can route calls differently than the calls that come into your cell phone.

And then also, it's really important that you know when there's an unknown number that rings you, that's because so often we see spam calls coming through. They're 30% up year over year, 30 billion spam calls and counting that, hopefully, the government is going to help reduce but that hasn't happened yet.

In the meantime, if you see an unknown number, well, what happens? You don't know if it's a spam call or if it's a new potential client because both are new callers to you.

So if you have that coming into your business number, much more likely to be something that you want to answer whereas your personal cell phone, it's really unknown if they're spoofing your numbers. They match the area code and you can't tell, but it's really a big corporation.

So be careful with that and protect your time.

And then also set clear expectations for how you will respond.

Because if you tell people when they'll hear back from you, and your business hours and how you work, they're more likely to wait for you to respond.

So if you have, let's say a receptionist service during business hours — and then after hours, it’s totally reasonable for your business to have a voicemail set up. If you just say in your voicemail, “Thank you for calling, you know, ABC financial planning firm. We're not here, so please leave your message, name, and number and a brief, you know, reason for your call.”

That doesn't tell anyone that it's after hours. They have no idea if you're going to pick up your phone.

It's sometimes as simple as just saying, "Thank you, you've reached us after hours. Our business hours are Monday through Friday, nine to five" and then ask for the information so that people know. And one of the things you can also say is, “We will get back to you within three hours of the next business day,” or whatever you want to say.

And that means that that new lead is likely to wait for you and not go and find another business that may be able to serve them, but probably not as well as you can.

So you want that lead and you want them to wait for you if they call you after hours. Simple things like that.

Also, a phone system that blocks your spam is going to mean that any new number that comes through is going to be relevant, hopefully, and you can also use these services judiciously at first if you have a lot of calls that are coming through.

Maybe it's existing clients and vendors, you're working with a marketing agency, they don't need to be answered by these services that you're outsourcing to if you use a virtual receptionist.

So have those pass through. Skip over. If they reach voicemail, it's not a big deal.

What you want to maximize is your responsiveness to new leads really.

IDENTIFY NEW-CLIENT CRITERIA

The next thing is identifying new client criteria. So before you can hand off anything like screening leads and scheduling consultations, you have to have a process in place. So think about the filtering questions that best gauge who's a good potential client for your company.

Typically, we find that five, six questions is enough to identify with 80% to 90% accuracy who is a good potential client for your firm, and then whether or not they are, you can schedule them for a consult, take payment for the consult to protect your time even further, etc.

But identify those coming qualities, how you're going to identify them with questions and then how you can share that form that logs those questions, often called an intake form online and share that, so that when you're outsourcing, you don't have to provision someone a new login to your software.

You can actually have them access it. And this is something that you can even allow clients to do themselves on your website. If you post that form as a button click online and you say complete this form, and then you'll be able to schedule a consultation.

These are automations that can help protect your time so that people complete that before they call you.

Now it's really important that you use affordable software here and one of the things that we love is if you're not even using a CRM, you can use a tool like Typeform or Gravity Forms combined with something like Calendly that's free that allows you to have the form filled and then the calendaring appointment that just gives visibility into your schedule.

So that you can handle this embedded on your website for very low to no cost.

And this is something that typically websites like WordPress, Wix, Weebly, they make it really easy to embed these solutions and then you're able to iterate over time.

So this may not be perfect, but it's really easy for you to update the forms and say, you know, I really need to add that question. Or I'm expecting clients to understand this, but actually, I need to be more proactive, not just to ask questions, but to share information.

No one's asking me how much my services cost and that's often a determinant of whether they're a good client. So I'm going to be proactive or I'm going to tell my receptionist to be proactive and say, "Just so you know, Joe's roofing company charges this much for these services, is that within your expectations?" etc.

Now, when you are standardizing this process, think about the entire flow and how someone is going to also have this consultation with you. Must you do it in person, or can it be a phone call?

If it is a call or a video call, are you requiring them to download some new software that's really going to waste your time because they haven't done it and then you spend the first 15 minutes of the call waiting for them to install the software.

These are things that can delay your time.

So as much as possible, improve their access to you with simple tools for things like consultations. And then also have a process in place if a consultation doesn't go as planned to have the referral happen to a firm you recommend which you can even often monetize based on your industry, sometimes attorneys, financial planners, etc. have some boundaries there.

But many companies can actually monetize as a second stream of revenue through referrals to other businesses if a client doesn't become a good potential fit for their firm or need to hire them.

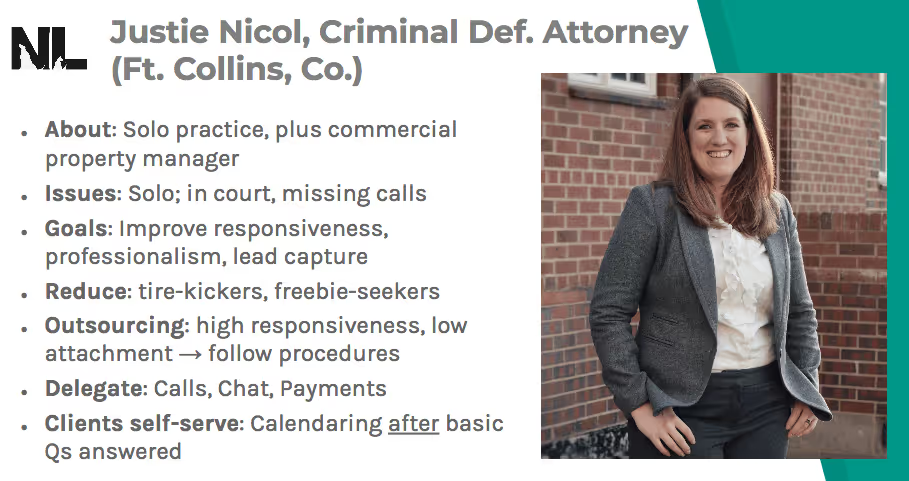

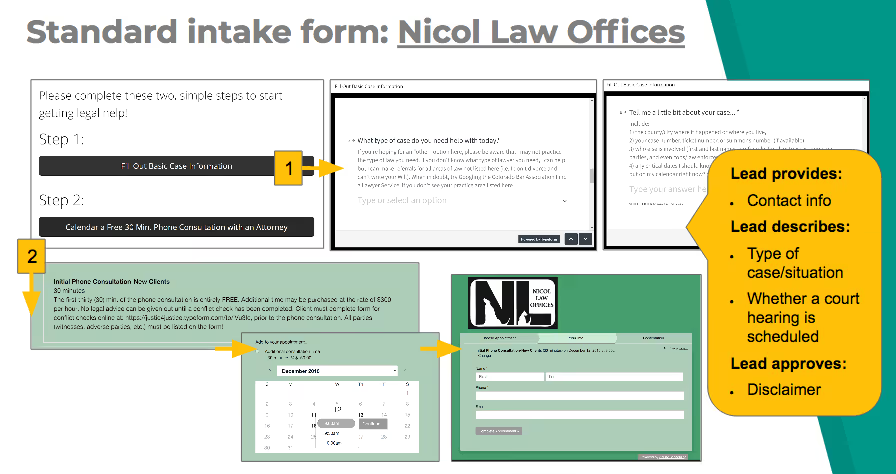

EXAMPLE

So one example that I have is Justie Nicol. She runs a criminal defense practice in Fort Collins, Colorado. She was really tired of tire kickers and freebie seekers for her firm. And she said, "You know what? I'm going to automate the heck out of this, and I'm going to put on my website a form and then calendaring. I do a free 30 minute consultation. After that it's $300 an hour."

And she hands this off to us with a phone call and then also with web chat so that we can be responsive on her behalf, because guess what? As a criminal defense attorney and in many other businesses, there are times when you actually can't pick up.

For example, you're in court, you can't pick up your phone and you're also, you know, facing a judge representing a client. I mean, there's no way that you actually are going to be able to answer as a solo small firm attorney. This is the case for many small businesses as well. There are things that you absolutely must do with your time that are commitments.

So how are you going to be responsive?

And then, also judicious in terms of filtering the new leads who are coming in so it's not willy-nilly — everyone gets to schedule with your Calendly, but it's protected. Only the best clients get to do so.

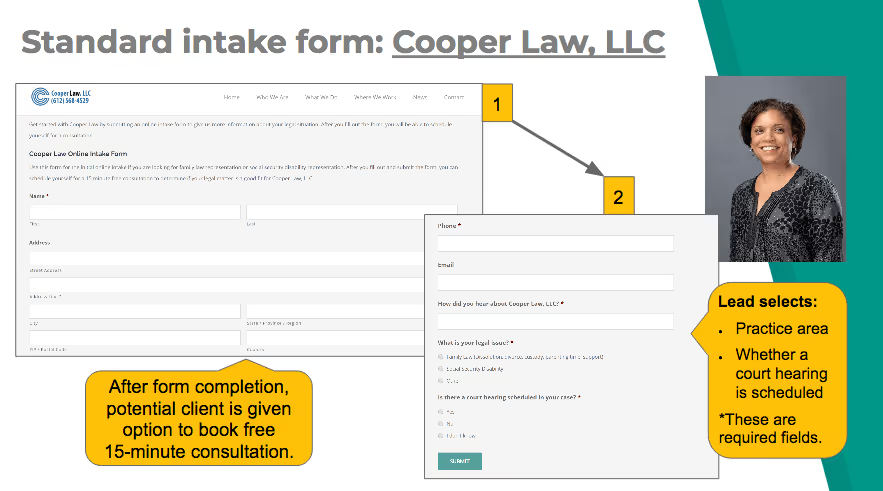

Embedding your form — and you're only asking for basic contact information — I really encourage you.

This is another law firm example. We work with many law firms to ask specific questions that filter leads. Emily Cooper, for example, she only works in family law and social security disability. Those are the two questions on her form. Do you have a matter related to family law or social security disability?

If you're an IT firm, is this a commercial request or a residential request? If it's — whatever parameters around your firm that you do or don't do, set those expectations and boundaries upfront and filter from the outset so that you don't have people who are needing follow-up because that's good business practice to be responsive; you reduce those people who are reaching out to you who are people you're not going to be able to serve or who you don't want to serve, whether you're able to or not.

You know who are good potential clients for your company. And you want to help them reach you.

And for people who are not a good fit, it's easy to say, even on your website, these are other businesses that I recommend that oftentimes people reach out to me with these sorts of requests. I don't do this, but here's who does, who I know, and who I wholeheartedly recommend.

Now, one of the other things you can do, not only to filter, but also to attract clients is to have a lead gen or magnet form that is initially helpful that helps you collect information for the best potential clients.

Now, imagine that you are running a landlord law practice, eviction notices, or something that they need, that you can offer an automate.

So this is something Chi City Legal has done that works in any different industries. There are plenty of online calculators out there that require you to share your information because that person who's completing that calculator is a really good new potential client for your company and then you're able to follow up with them in a way that is informed.

So they give you information when they put a calculation and you say, what should I be saving for retirement? If you're a wealth advisor and you put in your annual income and you put in your job, and then if you follow up with that person, you have a sense for approximately what sorts of services they need.

Now, the lead conversion flow: this is the step by step process of attracting and retaining a new client and this is sort of what we're getting through here. So for the example of the law firm this is sort of what it looks like from the lead source to the contact methods, the response method.

Typically in our industry, the answering service happens only at the contact method and then it's passed off to the attorney or to the financial advisor, the IT consultant, whoever it is.

We actually are able to communicate for you on your behalf through every step of this process until they become a new client or until it becomes the point where there's confidential information where you or someone on your staff is actually going to handle that conversation.

OUTSOURCE LEAD CAPTURE

So, we talked a little bit about outsourcing and lead capture. A form is required, typically we recommend a calendar as well and then you can automate people who don't fit your firm, for example, or who have not made the commitment to hire you I should say.

So let's say that they are a good potential lead. Put them into your email nurturing drip and then follow up with them. And after a period of time, have an assignment to your receptionist service to follow up with them and say, you know, "Is there a decision that you've made on this topic? And are you interested in hiring this law firm?" If so, you know, a document can be generated, and an invoice can be triggered.

So these are ways that you can have your systems work in sync.

So what I would recommend is that when you're looking to streamline and automate and outsource your lead capture and your nurturing, is that you look at your time for one week and you determine what is billable or revenue generating work for you and what is not.

What can you reasonably outsource and automate and streamline and really push yourself to think what you are not comfortable doing versus what do you really need to do? Because we often convince ourselves that we need to do things that are just out of our comfort zone, but actually really, truly can be effectively delegated and then prioritize fixes by what's consuming the most time.

What is most allowable for you to outsource and what is most urgent like client check-ins, lead qualification, payments — these are most often time-consuming and easily outsourced whereas data entry, follow-up, these are most easily automated. And then address the top couple in the next 30 to 60 days. You're not tackling too much.

You don't want to confuse any trends that come out of this or any impacts. You want to really pinpoint what's driving these changes that are positive.

So wait, let things stabilize, gauge the effects before you make too many changes at once.

And as you gauge the effects, think about not only the quantitative impact of more revenue, better leads, better saved time or consults with better qualified leads, but also your work-life balance, your stress, your sleep quality, etc.

So now I'll turn it over to Rachel and she'll talk a little bit about their outsourcing and automation solutions for accounting.

THE IMPORTANCE OF BOOKKEEPING

RACHEL:

Thanks so much, Maddy. I really appreciate that, too. That was super informative to me. I didn't even know you could outsource all those things so that's great.

Awesome.

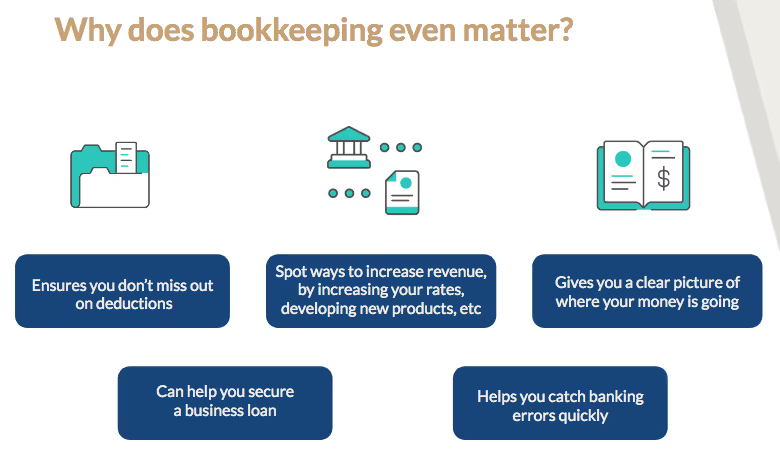

I already did a bit of an intro on what we do here at Bench so I'm going to skip onto the next slide here. So first off, we're going to start talking about why this bookkeeping even really matters.

And there are so many reasons having accurate financial records really helps identify ways that you're going to be able to increase your revenue and it's information that as a business owner, you shouldn't really be living without.

So first off, it ensures you're not going to miss out on deductions. I think I touched on this previously, but you might not know the entire small business tax code in and out, and you shouldn't have to. You didn't go into business to do that.

The more information and supporting documents that your CPA is going to have at tax time, the more deductions you'll be able to legitimately claim and the bigger tax return you're going to get.

Secondly, it can help secure business loans. If you need financing of any kind, having well-kept books is going to give lenders or investors a clear idea of your business's current financial state and it's going to allow them to make financial projections about your company's ability to pay off your loan in the future.

The next two are kind of one in the same. Spotting ways to increase revenue and giving a clear picture of where your money's going. You may be able to see your bottom line by glancing at your bank balance, but the ups and downs in your account are also telling you a story.

Are your sales up? Are your shipping costs too high? Who actually knows?

So paying attention to your final financial statements is a great way to get to know the story of your business. And then lastly, it helps you catch banking errors quickly. If you wait until the end of the year to reconcile all of your financial transactions, you don't know if the bank made a mistake until you're buried in paperwork at tax time and it can be way more difficult to reconcile and overcharge with your bank months later than if you had caught it right away.

CHOOSING THE RIGHT BOOKKEEPING SOLUTION

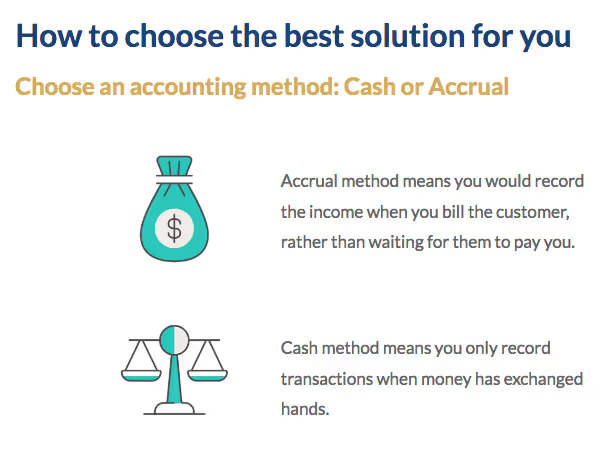

So there's a couple types of accounting methods, there's cash and accrual. So if you're using cash accounting, you only record transactions when money has exchanged hands. So if you billed a customer today, those dollars don't enter your accounting ledgers until the customer has actually paid you.

When using the accrual accounting method, you record the income when you bill the customer, rather than waiting for them to pay you. So at the end of tax year, you recorded all income that you earned during that year, even if you haven't collected it yet.

And this goes the same for deductions under the accrual accounting method, you deduct them when you're billed, not when you pay them.

If your company is inventory, in most cases, you'll be expected to use the accrual method and also, once your business average is more than 25 million in gross receipts (so gross receipts is any income before deductions), you must file on an accrual basis at tax time.

However, even if you have to file on an ongoing basis, you can still use cash throughout the year and your CPA will make the adjustments at year-end.

We recommend cash. Bench works on a cash basis and we recommend it.

For small businesses, it's a lot kind of easier to just follow along on the day to day. And it's a lot simpler too to do the books.

So there's a couple of solutions that we recommend just based on your business needs.

So first is doing it yourself either on QuickBooks or on Excel and there's some pros and cons of each solution. So, in a software like QuickBooks or Wave, it's usually the least expensive solution, and you're going to be able to get a broad set of features.

So you're usually able to get payroll, invoicing, bookkeeping, all in one for that really low fee.

However, as I said before, you don't know what you don't know. So there can be a huge time commitment in learning how to do everything properly and, as your business grows, you're not going to have time to keep up with it.

The next solution is hiring a local bookkeeper or accountant. So a lot of times when businesses go beyond lets say usually 30 employees, you're going to need a little bit more customization on your books where we would recommend hiring a local or in-house bookkeeper, or have your accountant complete your books.

This is usually the most expensive type of bookkeeping. But a lot of people value it because you actually get to see your bookkeeper face to face.

BEST FINANCIAL PRACTICES FOR SMBs

So some best practices here for bookkeeping that we see clients all the time not doing is separating your finances. So this one trips almost every business owner up. It's really tempting to pay for your business expenses with your personal bank cards and vice versa.

Our advice is just flat out, don't do it. All businesses except for sole props are legally required to keep personal and business finances separate.

Now when you co-mingle expenses, you're actually piercing the corporate veil and you remove the separation between you and your business. If the court sees that you've mixed your finances, they may disregard the protection of the corporate veil.

Therefore if you've incorporated, it's kind of negated there. And if your business is sued, you could be held personally liable for any debt or some of the money that your business is required to pay.

Separating your finances is also the smartest way to just simplify the admin and help you save money on unnecessary accounting fees, reduce your tax bill at your year-end, and save yourself from accounting headaches at tax time.

It's pretty simple, just don't pay for business expenses using your personal card.

If you're incorporated, make sure that you are using a payroll provider to pay yourself, versus just taking owner draws.

And so keeping records like a boss, financial and tax records prove that your business is actually making the income credits and deductions that you put on your tax return.

So everyone from your bookkeeper to your accountant and the IRS need you to keep documents, proving your income credits and deductions that you put on your tax return, right?

From the beginning, you should establish a system for organizing your receipts and other important records. Don't be old school about it, nobody likes sorting out the pile of receipts during tax season, that's how you lose track of all your deductions.

So we recommend using another outsource solution, like Expensify, to record all of your deductible purchases or Shoeboxed.

If you want Shoeboxed, you can actually just send in your shoebox of receipts to them and they'll sort them out for you. So the IRS doesn't require them to keep the receipts for expenses under $75, but it's always just a good habit nonetheless.

A couple more best practices here is tracking daily and monthly.

So a lot of times people will leave their bookkeeping until the year’s end and just hand all their paperwork over to their CPA, which we really don't recommend. It's not really good best practice for your business. There are so many insights that you can get by having daily tracking and monthly tracking. Daily tracking is really helpful.

Just trying to make those smaller decisions, like can I spend that extra money on Facebook this week, or can I take that client out to that fancy restaurant? So that's going to help you make those decisions and then having monthly tracking is super important because it's going to help you guide your financial decisions throughout the year.

Like, am I able to hire more employees? Can I actually invest in that piece of equipment? And more important decisions like that.

TIPS TO BETTER TRACK YOUR FINANCES

Here, we've got a huge list of tips to save and better track your finances. We often see clients that are doing it themselves often miss these deductions, there's a ton of resources online.

We have a really great blog post, actually, going through a ton of deductions, but just take some time and go find out what you could potentially be missing out on. And then on the right side here, we also have questions that should be reserved for a CPA.

So although a bookkeeper does have a ton of answers and usually can help you figure out what deductions you want, there are some questions that are better left to a CPA.

There's a reason they're a CPA. They went to school. They're going to be able to help you make bigger financial decisions on the structure of your business and specific tax regulations based on your industry.

AUTOMATING YOUR BOOKKEEPING

Alright, and then we wanted to go through several benefits of automating your bookkeeping here from small business owners. So mainly we see a huge stress relief at tax time and year long knowing that everything is accurate, done on time, and then as prior as guidelines.

We also see a lot of money saved from avoiding penalties by having taxes completed on time and not having to get a pricey CPA to complete.

And most importantly, getting back your own time, as we've talked about so much throughout this webinar, getting back your own time. So you can either use those as billable hours or time to focus on other areas of the business that you want to grow.

And then the last point here, this actually happens.

So knowing that your bookkeeper won't skip down or run late with your reports. From my time in sales here at Bench speaking to potential clients, I've actually heard this come up so many times.

I'm not saying all bookkeepers are bad, but just really make sure that if you are hiring a local in-house bookkeeper, that you really do your due diligence, and that they did them fully.

And then lastly, I wanted to provide a few resources that we find to be super useful. These are for both Maddy and myself. I won't go through them all in detail just for the sake of time, but I always recommend you to take some time and find out what resources are out there that can help you automate.

You'd be surprised and most of these platforms have free trials. You can test it out first and see if it will actually be useful.

CONCLUDING REMARKS

MADDY:

Yeah, definitely.

And one of the things that I have been so excited about recently is Gorgias, which is this hot key template for emails. So I basically like type in a couple of letters and then I have my email templates show up.

So instead of spending like time writing the same thing over and over again, or even hunting for the template that I've just logged as a draft, it makes it incredibly easy and they even have merged fields that make that easy, too. And you can automatically CC people.

So there's a lot of technology here that allows you to automate document generation and calendaring.

I mean, one of the biggest pains is still the back and forth of finding a time to meet or talk. So, if you're not using a calendaring solution, another one that's not even on here is Doodle. So I love that.

Just collectively get the votes for when people can meet. You can use it for a dinner party, you don't even have to use it for work, but I find that these tools are actually things that either we use or our clients adore and because we're sort of the frontline as receptionists.

People are always asking us, you know, what’s some other technology that I can implement that's going to be as impactful as yours.

Well, these are things that Rachel and I both have come to really know and love.

RACHEL:

When I started at Bench, I was pretty new to the tech industry. So I didn't know that there were all of these amazing tools that you could use. And I'm still shocked every single day by how helpful these tools are. I don't know how I got as much done without them.

MADDY:

I've been working for a while now, and like, I don't know how I got, you know, I'm just incredibly efficient now. And I actually find that my work satisfaction is much greater because I'm not spending as much time on these really dull sort of routine tasks, you know? So, what can you do next?

With code bench50 (bench-five-zero), you'll get $50 off.

And then put these systems in place and just take a beat and say, "How is this working for me now?"

We just shared a ton of resources with you, of software and other services, that are fantastic.

Do only a couple things at once, so that you're not overwhelmed by the amount of change at your small business and you want to measure the impact.

So I encourage you, if you would like more information, please get in touch with us. We would be happy to be a resource for you. There are plenty of questions that we see all the time. Don't be shy. You won't be the first person to ask it and there's nothing too small or silly to ask.

So we're providing our emails here on purpose and encourage you to reach out either through LinkedIn or through email.

And we really appreciate your time today, folks. Thank you so much and thank you, Rachel.

RACHEL:

Yeah. Thanks so much for having me, Maddy. That's great.

MADDY:

Wonderful, Talk to you soon.

Questions? Contact Us.

Have any questions about Smith.ai's virtual receptionists services or anything else mentioned in this webinar? Call us at (650) 727-6484 or email us at support@smith.ai.

If you’d like to learn more about how Smith.ai’s virtual receptionists can help your business, sign up for a free consultation with our team or get started risk-free with our 30-day money-back guarantee!

To watch more webinars like this one, check out our YouTube channel or access articles, guest blog posts, and other resources on the Smith.ai blog.

Take the faster path to growth. Get Smith.ai today.

Key Areas to Explore

Your submission has been received!

%20(1)%20(1).avif)

.svg)