The Ultimate Guide to Mortgage Business Software

The Ultimate Guide to Mortgage Business Software

Running a mortgage business shouldn't cost you your personal time. But unpredictable calls, messy processes, and disconnected client experiences often do exactly that. Manual workflows and inconsistent branding slowly steal your freedom — the very thing you built your business to protect.

Mortgage business software solves these problems through integration and automation. The global loan origination software market proves it — going digital can cut cycle times by up to 30% while making clients happier.

Understanding Mortgage Business Software

Mortgage business software digitizes and simplifies the lending process. From applications to closing, it turns manual work into digital systems.

Core Functionalities of Mortgage Business Software

Mortgage software handles the essentials: loan origination that automates data collection and risk analysis, underwriting and approval systems with automated credit logic, secure document management and storage, compliance monitoring that tracks regulatory requirements, and client communication tools that enable real-time borrower interactions.

Market Trends in Mortgage Business Software

The industry is moving toward AI-driven insights for predictive analysis and automated decisions, mobile accessibility for anytime access, cloud-based deployment that offers scalability, easy integrations with CRMs and banking tools, and user-friendly interfaces that boost adoption.

The loan origination software market is expected to grow at 12.1% CAGR through 2028, showing strong demand for digital tools.

Top Mortgage CRM Software Platforms in 2025

Before diving into features, here's how the leading platforms stack up:

Creatio stands out for its no-code customization and AI-powered lead scoring. Pricing starts at $25 per user monthly, making it accessible for smaller teams while offering enterprise scalability.

Shape Mortgage Software specializes in mortgage-specific workflows with built-in compliance tracking. Their integrated approach handles everything from lead capture to closing, though pricing requires custom quotes.

BNTouch focuses on real estate and mortgage professionals with strong social media integration and automated nurturing campaigns. Plans begin around $39 monthly per user.

mondayCRM offers excellent project management integration alongside CRM functions, ideal for teams managing complex loan pipelines. Pricing starts at $12 per user monthly.

Keap provides robust automation for small to medium mortgage brokers, with plans starting at $199 monthly for up to 1,500 contacts.

Essential Features That Drive Mortgage Business Success

Not all platforms are created equal. These capabilities separate the best from the rest.

Lead Management and Scoring

Effective mortgage CRMs automatically capture leads from multiple sources — your website, social media, referral partners, and advertising campaigns.

Advanced platforms like Creatio use AI to score leads based on loan amount, credit indicators, and engagement patterns. This helps your team focus on the most promising prospects first.

Look for systems that track lead sources and measure conversion rates by channel. This data helps you invest marketing dollars where they generate the best returns.

Pipeline and Opportunity Management

Your CRM should visualize every loan in your pipeline with clear stages: initial contact, application submitted, underwriting, approval, and closing.

Automated stage progression keeps deals moving and prevents applications from falling through cracks.

The best platforms send alerts when loans stall too long in one stage or when key deadlines approach. Shape Mortgage Software excels here with mortgage-specific milestone tracking.

One lender reduced processing time by 30% by connecting their LOS and CRM.

Communication and Nurturing Tools

Modern mortgage CRMs automate client touchpoints throughout the loan process. Automated email sequences keep borrowers informed about next steps, required documents, and timeline updates. SMS integration handles urgent notifications and appointment reminders.

BNTouch specializes in this area with social media monitoring that alerts you when past clients post about moving or refinancing, creating natural follow-up opportunities.

Document Management and Compliance

Mortgage lending generates massive paperwork. Your CRM should centralize documents, track collection status, and flag missing items. Integration with e-signature platforms speeds the process while maintaining audit trails.

Compliance features vary significantly between platforms. Some basic CRMs offer document storage, while specialized platforms like Shape Mortgage Software include built-in TRID compliance, automated disclosures, and regulatory reporting.

Integration Capabilities

Strong integration builds a connected ecosystem. APIs should link your CRM with loan origination systems, accounting software, and marketing tools. Bank and credit bureau integrations eliminate manual data entry and reduce errors.

Time savings come from eliminating duplicate data entry and automatic status updates between systems. Automating billing and invoicing also reduces admin work, keeping records clean and processes smooth.

Security and Compliance

Essential security features include encrypted data protection, role-based access controls, audit trails for accountability, and built-in compliance checks.

Scalability and Customization

A system that grows with you needs cloud-based tools that scale on demand, microservices architecture that supports modular growth, custom workflows that match your operations, and multi-region support that adapts to regulations.

Like property management platforms, mortgage systems must scale and adapt.

Benefits of Investing in Mortgage Business Software

Mortgage business software gives you back your time and freedom.

Operational Efficiency

A lender using LoanPro cut loan delivery time by 97%, allowing agents to handle triple the volume without new hires.

Firstsource helped a top mortgage provider achieve 30% greater efficiency and a 20% shorter cycle.

Improved Client Service

Efficiency leads to better service. With more time for clients, staff can personalize interactions, building loyalty and encouraging referrals.

AI can boost satisfaction by 20% and conversions by 30% through smarter interactions.

Better Decision-Making

Real-time data leads to faster, more accurate decisions. Vellum Mortgage used analytics to spot trends and grow strategically.

Complete Cost Analysis: What You'll Really Pay

Understanding the true cost goes beyond monthly subscriptions. Here's the full picture:

Subscription Costs by Business Size

Small Teams (1-5 users): Expect $50-$300 monthly total. Platforms like MondayCRM ($12/user) or basic Keap plans work well here.

Medium Operations (6-25 users): Budget $300-$1,500 monthly. Creatio and Shape Mortgage Software fit this range with their mid-tier plans.

Large Enterprises (25+ users): Plan for $1,500-$10,000+ monthly. Enterprise features, custom integrations, and dedicated support drive these costs.

Hidden Implementation Costs

Data migration typically costs $2,000-$15,000 depending on your current system complexity. Custom integrations with loan origination systems add another $5,000-$25,000. Training costs range from $1,000-$5,000 per team, though some vendors include basic training.

ROI Calculation Framework

Calculate your potential savings: if you process 50 loans monthly and reduce cycle time by 20%, that's 10 extra loans. At $3,000 average profit per loan, you're looking at $30,000 additional monthly revenue. Most CRM investments pay for themselves within 3-6 months.

Step-by-Step Selection Framework

Step 1: Assess Your Current Workflow

Map your loan process from lead capture to closing. Identify bottlenecks where applications stall, compliance issues arise, or client communication breaks down. Document how many leads you handle monthly and your current conversion rates.

Step 2: Define Must-Have vs. Nice-to-Have Features

Must-haves typically include automated lead routing, compliance documentation, integration with your loan origination system, and mobile access. Nice-to-haves might include advanced analytics, social media integration, or custom branding.

Step 3: Evaluate Integration Requirements

List every system you use: loan origination software, accounting tools, email platforms, and phone systems. Verify that your CRM choice integrates with these or offers comparable built-in functionality.

Step 4: Test with Real Scenarios

Request demos using your actual loan scenarios. Import sample data, test workflows, and have team members interact with the interface. This reveals usability issues that specifications can't capture.

Step 5: Calculate Total Cost of Ownership

Factor in subscription fees, implementation costs, training time, and ongoing support needs. Compare this against projected productivity gains and revenue increases from faster processing.

Implementation Best Practices

Vendor Evaluation Criteria

Ask vendors about their lending experience, update frequency, and support standards. Defi Solutions recommends evaluating vendors as long-term partners. Request references from similar-sized mortgage operations and verify uptime guarantees.

Planning Your Rollout

Successful implementations start with data cleanup in your current system. Export clean contact lists, loan histories, and document templates before migration begins.

Capacity recommends starting training early and customizing by role. Loan officers need different functionality than processors or compliance staff.

Measuring Success

Track key metrics before and after implementation: lead response time, loan cycle duration, conversion rates by source, and client satisfaction scores. Most platforms include built-in reporting for these metrics.

Vendor Reputation and Support

Ask vendors about their lending experience, update frequency, and support standards. Defi Solutions recommends evaluating vendors as long-term partners.

Cost vs. Value

Weigh total ownership costs against returns. Operational gains, lower risk, and higher retention often far outweigh upfront fees.

User Training and Onboarding

Successful rollout depends on adoption. Capacity recommends starting training early and customizing by role.

Advanced Capabilities of Modern Mortgage Software

AI-Powered Lead Qualification

Advanced CRMs now use machine learning to qualify leads automatically. These systems analyze application data, credit indicators, and behavioral patterns to predict loan approval likelihood. This helps loan officers prioritize their time on the most viable applications.

Predictive Analytics and Forecasting

According to Cognizant, predictive analytics help mortgage professionals anticipate client needs and market trends. Modern CRMs track patterns in your pipeline to forecast monthly closings, identify seasonal trends, and predict which loans might encounter delays.

Mobile-First Design

Today's mortgage professionals work from anywhere. Leading CRMs offer full mobile functionality — not just viewing data, but capturing leads, updating loan status, and communicating with clients from smartphones and tablets.

API-First Architecture

The best modern platforms use API-first design, making them incredibly flexible for integrations. This matters because mortgage businesses often use specialized tools for credit reports, flood certifications, appraisals, and title work.

Conclusion

You didn't start your mortgage business to drown in paperwork. You wanted freedom, growth, and a meaningful way to help clients.

Mortgage business software gives that back. It replaces manual work with smart automation, improves compliance, and helps you serve more borrowers with less stress.

Picture leaving on time, confident your systems have it handled. Imagine weekends free from backlog or burnout.

Your success shouldn't cost your peace. Let technology make that balance possible.

Book a free consultation today to explore solutions for your mortgage business.

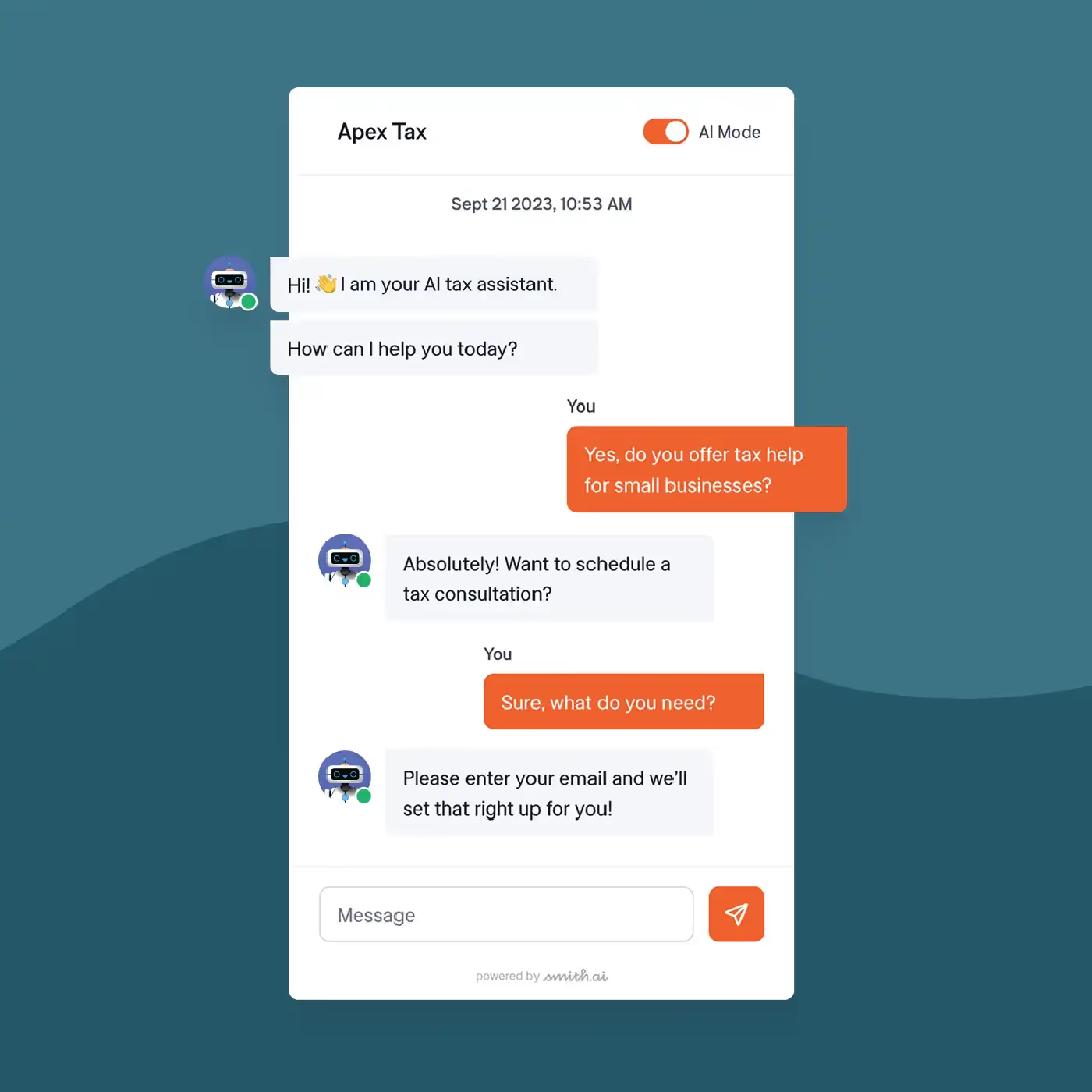

Take the faster path to growth. Get Smith.ai today.

Key Areas to Explore

Your submission has been received!

.svg)