The Top 10 Online Payment & Billing Solutions for Financial Planners & Wealth Advisors: Manage Getting Paid as Well as You Manage Your Portfolios with These Free and Paid Tools

The Top 10 Online Payment & Billing Solutions for Financial Planners & Wealth Advisors: Manage Getting Paid as Well as You Manage Your Portfolios with These Free and Paid Tools

In the business of finance, money is literally everything—earning it, saving it, and making sure that people are paying it when it is due—these things are the backbone of every successful business. Financial planners and wealth advisors are great with other people’s money, but they’re not always so good with their own. Fortunately, there are several tools available today that can take the hassles off of your hands and give you the chance to get more out of your billing solutions.

In the list below, we’ll take a look at the 10 best payment and billing solutions that are available, including some general use products and some that are designed specifically for the finance industry. By taking the time to review all of the available options, you’ll be able to see which features you should be looking for and how you can improve your own billing and accounting with these tools.

But what should you be looking for? We’re glad you asked. In any good payment and billing platform, you’ll want to ensure that it offers invoicing tools, online payment options, email invoices and reminders, automated notifications and other automations, recurring billing, and more. Think about which features would most benefit your billing and focus on those as a priority.

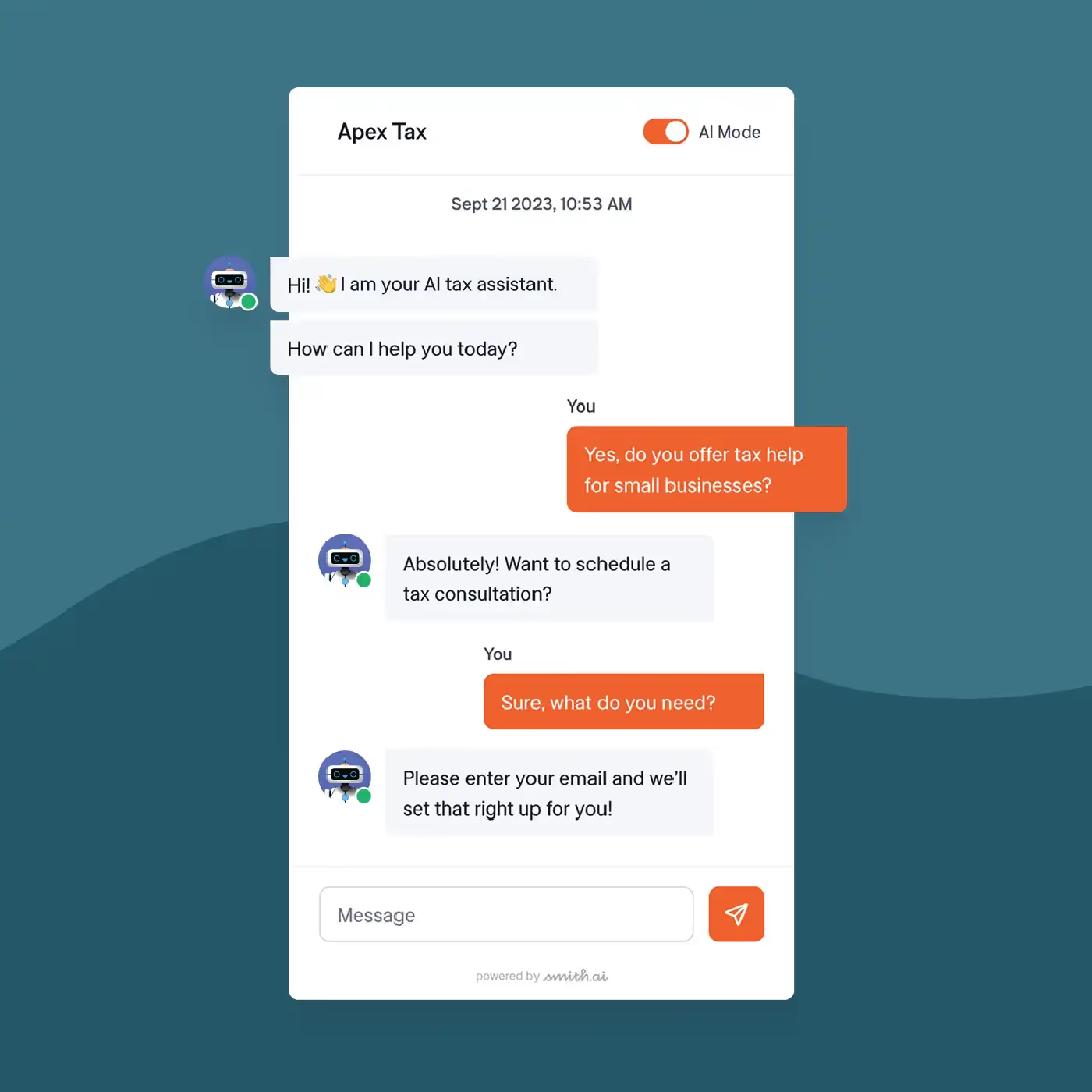

And when you’re looking to make your clients a priority, find out how the virtual receptionists at Smith.ai can help you streamline plenty of administrative tasks and act as the face of your brand to handle payment collection, 24/7 answering services, and even live website chat, and so much more.

1. FreshBooks

FreshBooks is a popular choice for easy, affordable billing and payments. It’s a generalized solution that isn’t really dedicated to the industry, but it still offers a lot of features that financial planners and wealth managers will love. For starters, it comes with a handy double-entry accounting feature to ensure that mistakes don’t happen, and things are accounted for at all times. There are even time tracking tools and a client database that makes it easy to monitor accounts and bills.

FreshBooks allows you to customize invoices and automate payments. You can setup recurring billing for clients and even send out automated reminders. Payment processing is done on a flat-fee basis, and there are apps available for Android and iOS so you can get paid anywhere, and even send invoices on the go. The retainer/deposit feature is great for billing for those extras, and you’ll also enjoy the highlights like:

- Free option? No

- Price: $15 per month to start

- Customer database for easy tracking

- Open API for custom integrations

- Payment processing on flat-fee basis

- Mobile apps and invoicing

- Deposit/retainer feature

2. Invoicely

Invoicely is one of our favorite options for cheap and free tools. In fact, Invoicely has plenty of free invoice templates and a plan that offers free forever billing and payment solutions with limited features. The best part? Those “limited” features really aren’t. You still get robust Android and iOS apps, detailed reporting tools, customization, and automation of all kinds.

Invoicely allows you to custom-brand all of your invoices. You can calculate and control things like shipping costs, taxes, and discounts, and even track time and expenses to make sure that your payroll accounting is on point, too. On the intuitive dashboard, you’ll even find custom labels that will help you create an organized space to manage it all, too.

Check out highlights like:

- Free option? Yes

- price: Starts at $10 per month

- Dedicated apps for iOS and Android

- Detailed reporting

- Real-time dashboard

- Customization available

- Automated workflows

- Free forever basic plan

3. Xero

With Xero, financial professionals will find it easy to manage their business billing and payments. The platform includes project tracking features and interactive quotes so that your clients can keep tabs on what’s going on. The bank account synchronization is flawless and makes it easy to move money when needed, and you can even track and claim expenses so that everything is managed in one place.

Xero offers custom invoicing and makes it easy to reconcile your billing and payments. You can, of course, set up recurring payments and automated reminders, along with automated workflows and other AI. Plus, it has an API that integrates with all kinds of software, so it should fit right into your existing tech stack. Plus, it’s all done at impressively affordable prices. Check out highlights like:

- Free option? No, but there is a trial

- Price: Starts at $11 per month

- Custom invoices

- Electronic bank account sync

- Interactive quotes and estimates

- Payment processing integration

- Mobile apps

- Real-time dashboard and reporting

4. Wave Accounting

Wave Accounting has one of the best options for flexible payment and billing solutions. In the world of financial advising and wealth management, you know the value of only paying for what you need. However, you also know that you need to get paid quicker and with less hassle—and that’s where Wave delivers. The platform offers recurring payments and billing features, along with free professional invoices and the ability to integrate with your existing software stack.

Wave Accounting is loved by many because there are free features, and then there are the features that you only pay for when you use them. Having that kind of flexibility and not having to spend a monthly fee on a suite you never use—that's what the modern business demands. Wave offers payroll and tax tools and programs, as well as the chance to brand your invoices, scale the platform to your needs, and even manage it all from a customizable dashboard.

Check out key features like:

- Free option? Yes, some features are free

- Price: $20 per month for monthly plans, other features pay-per-use

- Integrates with existing tools and software

- Free professional invoice templates

- Recurring billing

- Pay-per-use pricing

- Payment processing gateway available

5. AdvicePay

For fee-for-service financial planners and advisors, AdvicePay is a great billing solution. This platform includes all kinds of tools and features that make getting paid easy, and comes with enterprise solutions and startup options alike. This tool is dedicated to the financial planning industry and is the only solution currently available for FFS planners. It includes flexible billing options, RIA compliance, and payment processing that will integrate easily for everyone.

AdvicePay also includes a customizable experience for clients and a fee calculator, along with premium data security and personalized support. You can send recurring invoices, set up automated payments, turn billed hours into invoices in seconds, and more. Plus, the essential plan is just $10 per month for independent advisors, which makes it an affordable choice for all.

Check out the key features:

- Free option? No

- Price: $10 per month to start

- Recurring and automated billing

- Customizable invoices available

- API for easy integrations

- Approval features

- Integrated payment processing

6. Intuit QuickBooks

QuickBooks by Intuit is a program that’s no stranger to the game of getting paid. This billing and accounting software has been around longer than many of the new apps on this list, and it has continued to evolve and grow over time to keep up with the necessary changes. This program comes in several iterations today and seems to have a solution for just about every industry.

Plus, with cloud-based options, you can scale it to your exact needs and it’s even available on mobile these days. Receipt capture makes turning expenses into accounting entries easy, and you’ll be able to handle taxes, payroll, and vendor expenses all while making sure that you’re getting paid quickly and accurately.

The key features include:

- Free option? No, but a trial is offered

- Price: $15 per month to start

- Receipt capture feature

- Mobile tools

- Manage vendor and project expenses

- Handle taxes and payroll

- Automate payments

- Recurring billing features

7. Invoice Ninja

Invoice Ninja is an open-source tool for billing and getting paid that is changing the game. When you’re tired of bulky software and legacy solutions that limit your capabilities, this platform is one that should be on your list. You can use this tool to manage projects and billable hours, create proposals, and even turn estimates into invoices with just a click or two. Custom-brand everything and choose the free forever option to do it all without spending a dime.

With Invoice Ninja, you’ll be able to track time, automate billing, and even create invoices in real-time. You can send bulk invoices, export billing, create expense reports, and even convert your timed client hours into bills with just one click. Sure, those “custom quote” solutions look nice, but if you don’t really need all of that, consider a solution like this. People love the highlights:

- Free option? Yes

- Price: $10 per month to start

- Time tracking

- Real-time invoicing

- Automated billing

- Easy payment processing integration

- Custom template creation

- Estimate-to-invoice conversion

8. EBizCharge

EBizCharge is one of the custom solutions on this list, so we can’t comment on the affordability when compared to other tools here. However, what you get for that custom pricing is a custom billing solution that makes getting paid and paying your own bills easier than ever. It even includes a customer-facing portal that allows your clients to pay online, anytime—no more excuses about limited payment options.

EBizCharge allows you to create custom invoices, set up recurring bills and email invoicing, and even generate detailed, real-time reports that will help you stay updated on what’s going on with your accounting from all angles. You can setup payment acceptance across all channels and there’s plenty of automation included, as well.

Highlights of this tool include:

- Free option? No

- Price: Custom quote

- Over 100 integrations

- Email payments

- Mobile apps

- Multichannel payment processing

- Detailed real-time reporting

9. FreeAgent

With the FreeAgent platform, financial planners will find plenty of customized solutions for billing and getting paid. The software is designed for smaller firms and solo users who need a scaled solution that’s customizable and affordable. This tool includes project management tools, expense tracking, recurring billing, and more. The platform integrates with plenty of tools, and you’ll even find automated reminders and email invoicing tools.

FreeAgent also has apps for Android and iOS so that you can manage your billing from anywhere. You’ll enjoy no contracts and no setup fees, and new customers can even get discounts on their membership when they sign up. For those who want a flexible billing solution that’s affordable and delivers plenty of features without skimping, this platform is worth a look.

Plus, check out key highlights like:

- Free option? No, but a trial is offered

- Price: Starts at $12 per month

- Seamless integrations with hundreds of tools and apps

- Recurring and automated billing

- Project/client management tools

- Expense tracking

- Mobile apps

10. AdvisorBOB

AdvisorBOB is a dedicated billing and payment solution for financial planners and wealth advisors. It allows people a way to get away from legacy products to find an easier way to track expenses, costs, and financial goals for their advisors and their firm as a whole. The user interface offers an overview and plenty of tracking tools to make sure that you always know what’s going on.

You'll also find tools for payout reports, revenues, expense tracking, and aggregating commissions. You can even analyze all of your bills and invoices to make sure that fees, payouts, rep IDs, and other details are covered so that the right people are getting credit and the right bills are getting paid. There are tools for invoicing and payment processing, and integrations are easy.

Check out highlights like:

- Free option? No

- Price: Custom quote

- Line-by-line accounting that’s fully automated

- Custom solutions for financial advisors

- Commission and rep ID tracking

- Direct billing with one-time or recurring options

- Tax and expense tracking solutions

- Detailed account billing and tracking

Make sure mission critical tasks are handled with the help of Smith.ai

In addition to integrating the latest software tools and apps, you can also integrate the services of our virtual receptionists. The team at Smith.ai is dedicated to helping with your billing and payments, lead intake and client services, and so much more. We can even handle payment collection and 24/7 live website chat so that your clients are never without the assistance they need when they’ve got questions about their bills (or anything else, for that matter).

Schedule your consultation now and find out how our virtual receptionists can help further automate and streamline your payment and billing solutions so that you can focus your efforts where they are needed—on managing your clients’ financial assets and helping them grow their wealth. You can also reach us at hello@smith.ai or (650) 727-6484.

Take the faster path to growth. Get Smith.ai today.

Key Areas to Explore

Your submission has been received!

.avif)

%20(1)%20(1).avif)

.svg)