How to Prepare For Selling Your Small Business

How to Prepare For Selling Your Small Business

The following is a guest post by Marla DiCarlo, co-owner and CEO of Raincatcher.

Whether you’ve experienced years of success and have reached retirement age or you’re looking to sell your company for a profit, you may be presented with the unique opportunity to sell your small business. While there are a variety of interconnected aspects that go into a successful sale, there are several key steps that every entrepreneurs and business owner should be aware of. By proactively working to ensure that you’ve prepared your business for new ownership, you can maximize your profits and set it up for continued success. Here we present several essential elements to keep in mind while you prepare to sell your business.

Search For a Professional Valuation

One of the first things that you should do before considering selling your business is obtaining a professional valuation of your business’s worth. This will provide you with a realistic idea of the worth of your business, and it will help you gauge offers from buyers. Further, many professional valuations will also offer information about the strengths and weaknesses of your business’s market, which will ultimately reveal your market position and financial situation.

You can obtain a valuation from a variety of sources, including regional business brokers, investment firms, and even local accounting firms. But before hiring anyone, you should always check to ensure they have access to national data regarding sales in your industry. Overall, obtaining a professional valuation is one of the best ways to set your business up for a successful, profitable sale that is smooth and quick.

Talk With Your Financial Advisor

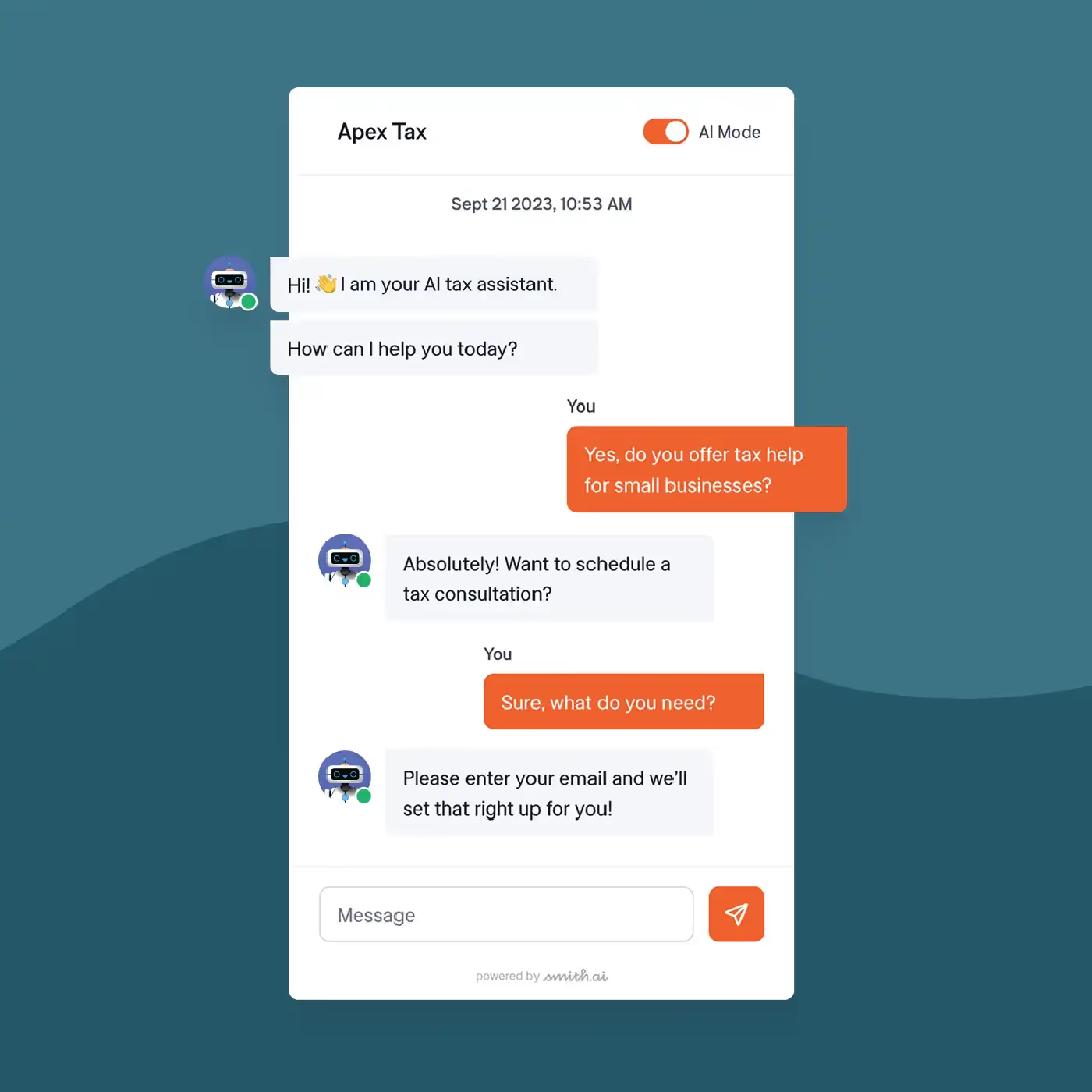

Much like you get a professional evaluation of your business, it is also essential to speak with tax and financial advisors in order to plan your finances for the future. By planning out your future and gauging the level of savings that you will maintain, you can lessen the chances of encountering financial surprises after the sale. Corporate and personal taxes can sometimes be extremely difficult to sort out, and the expertise of an advisor can be invaluable in avoiding costly tax pitfalls. Schedule some time with your trusted advisors to ensure your continued financial independence.

Organize All of Your Books

Likewise, one of the most important elements of preparing your small business for sale is to get all of your books in order. Frequently, buyers will require nearly three years’ of financial information while they evaluate your business. If your books are well-organized and formal in their structure, you can easily make a phenomenal first impression on buyers. Plus, it makes it easier for investors to perform their due diligence and may often speed up the process of selling. First impressions are essential in getting the most out of a sale, and your books are one of the first elements of your business that any buyer will view. Slow down, take some time, and put in the hard work!

Craft a Plan For Management Succession

Buyers often worry about the small business's transition to new ownership. Quell these fears by creating a detailed plan which outlines how you will turn over leadership. Your employees will also have peace of mind that their routines won't be upended under new management. By crafting a succession plan before you go to market, you can provide buyers with the opportunity to fully evaluate your business without worrying about the future.

Know Why You're Selling

Often, one of the first things potential buyers ask small business owners is why they're selling. Be prepared to articulate your reasons in a concise, detailed manner. If not, they may worry about your true reason for leaving and may even back out of a sale. It is always important to be prepared for anything, and slowing down to craft a statement may be valuable if they question you.

Ultimately, it can sometimes take a year or more for the completion of sale, so patience is always necessary. However, if you take the time to organize your business and financials, you can make your company look as strong as ever.

Take the faster path to growth. Get Smith.ai today.

Key Areas to Explore

Your submission has been received!

.svg)